Nikki M Group typeset Microequities Initial Public Offering (IPO) 2018.

Our services included:

Microequities supplied branding assets, text files and spreadsheets, which were used to prepare the prospectus.

Our design brief was to:

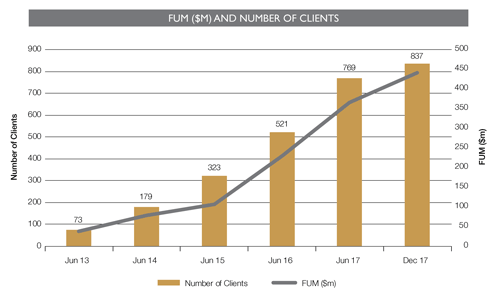

Microequities manages funds exclusively for high net worth, wholesale and sophisticated investors wanting to invest in microcaps. In 2017, Microequities’ funds under management (FUM) was $442 million, which represents compound growth of approximately 69% per annum over a three-year period.

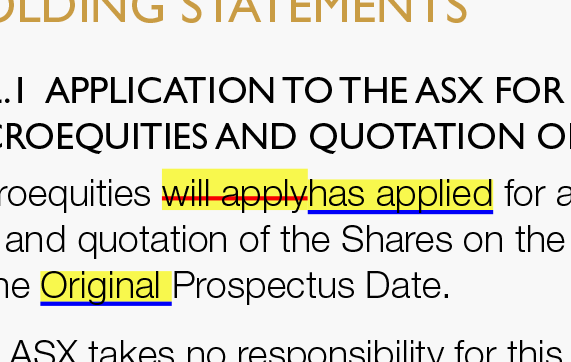

During the development of the prospectus, blacklining was used to track changes. Blacklining provides a way to track changes, so that clients can see exactly what text has been changed, deleted, inserted and/or replaced.

Blacklining assists companies to comply with the requirements of the ASX Listing Rules (Section 2.5 Fast track process for offers proceeding by pathfinder prospectus or PDS).

Call +61 3 9584 6021

Talk to us about your project

Find out more about our design and typesetting services.

Financial graphs and charts were created from data provided by Microequities. The data was used to precisely create information graphics in a style that was consistent with their corporate identity.

Information graphics included:

Information graphics communicate ideas visually and make it quicker and easier to understand complex data.

Do you have a Microsoft Word or Excel document that you want to develop into a report?

Nikki M Group provides consultation services to help you get started.

Get up-front advice and costing.

Total pages

108